Key Takeaways

Contribution rates are fixed and must be calculated accurately

Employers must calculate the epf contribution malaysia correctly: 13% for employees earning RM5,000 and below, or 12% for those earning above RM5,000, while employees contribute 11%. Using official KWSP tables ensures accurate deductions.

The employer’s share is part of your responsibilities

The epf company contribution is the portion paid by the employer. It must be remitted on time and reconciled with employee contributions to meet employees provident fund requirements.

Handling the Malaysia EPF contribution process isn’t just another HR task—it’s a legal duty and a reflection of how seriously your company takes employee welfare and statutory compliance.

Never miss any important news. Subscribe to our newsletter.

From contribution rates and deadlines to salary inclusions and recordkeeping, EPF compliance can be a minefield for SMEs and startups—especially without internal HR expertise.

And with KWSP enforcing the Employment Act 1955 more rigorously, even small errors can result in hefty penalties and a damaged reputation.

If you’re running a Malaysian business, this guide covers the 10 crucial EPF rules that every employer should know—and how outsourcing to HR professionals like MUSTRE can help you stay compliant, efficient, and worry-free.

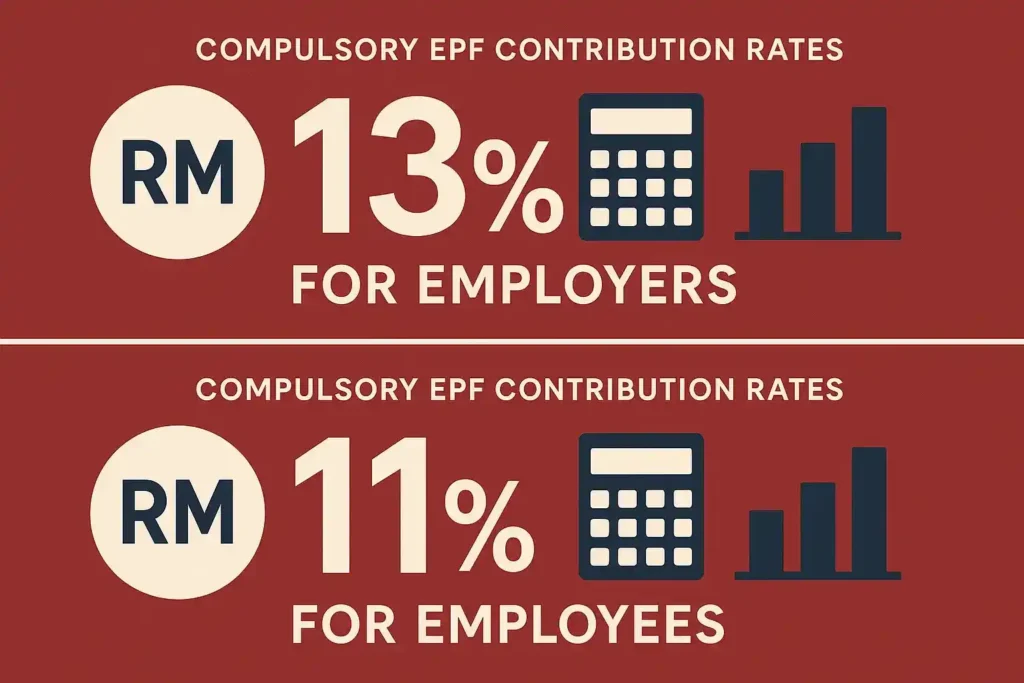

1. Know Your Mandatory Contribution Rates

The Malaysia EPF contribution for employers is set at:

- 13% for employees earning RM5,000 and below

- 12% for employees earning above RM5,000

Employees contribute 11% of their monthly wages across all income levels.

These percentages apply strictly to Malaysian citizens and permanent residents.

No room for negotiation.

2. EPF Registration Is a Non-Negotiable First Step

Your company must be registered with KWSP as soon as you start hiring.

Likewise, each employee must be enrolled under the EPF scheme.

This is a legal requirement under the EPF Act 1991, not an optional HR initiative.

3. Respect the Monthly Contribution Deadline

EPF payments must be made by the 15th of every month.

Late payments don’t just trigger dividend charges—they can attract fines and even legal action.

This one rule alone is worth automating or outsourcing.

4. Understand How to Calculate Contributions Correctly

Always refer to KWSP’s official EPF Contribution Table.

Factors include:

- Age group

- Salary bracket

- Citizenship or PR status

For example, a Malaysian employee earning RM4,000 will see RM520 go to EPF monthly (RM440 from the employer, RM440 from the employee).

5. Be Clear About What Counts as EPF-Inclusive Wages

Included:

- Basic salary

- Allowances

- Overtime

- Bonuses

- Commissions

Excluded:

- Reimbursements

- Retirement gratuities

- Travel claims

Knowing the difference can prevent costly over- or under-contributions.

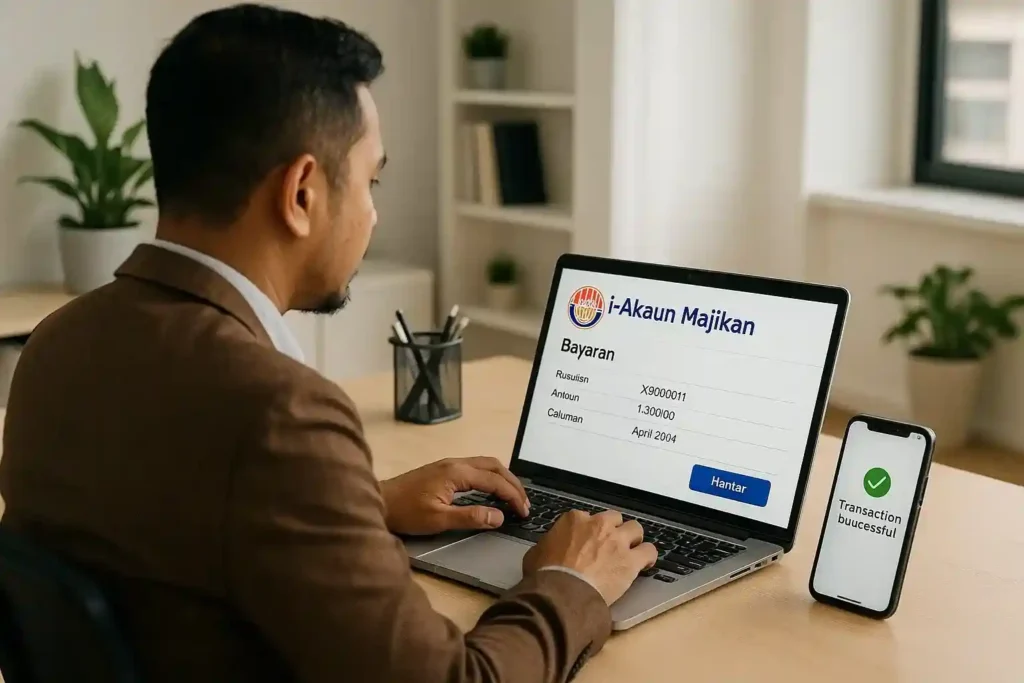

6. Use Online Channels for Smooth Remittance

Employers are encouraged to remit contributions through:

- KWSP i-Akaun (Employer)

- FPX-enabled online banking

- Integrated payroll software

These tools help reduce manual error and streamline monthly processes.

7. Deducting Employee Contributions the Right Way

The employee’s 11% contribution must be deducted before salary is paid and clearly reflected in the payslip. Failing to do so correctly can breach labor laws and create mistrust.

8. Non-Compliance Has Serious Consequences

Missing or delaying EPF payments could result in:

- Dividend charges

- Fines up to RM10,000

- Legal prosecution and audits

- Forced back-payments

Why take the risk when professional services like MUSTRE exist to help?

9. Maintain a Trail of Records and Reconciliations

Make sure to:

- Track monthly payments

- Keep up-to-date employee records

- Cross-check all figures with KWSP receipts

Digital HR platforms or outsourcing partners can help you stay audit-ready.

10. Handle Voluntary and Special Contributions Properly

Sometimes you may opt for:

- Voluntary employer top-ups

- Reduced contribution rates during approved government periods

- Third-party contributions (e.g., religious or welfare bodies)

Ensure these are processed correctly to avoid future complications.

Why Employers Struggle with EPF—and How to Fix It

Common Pitfalls:

- Overlooking age-based rate changes

- Forgetting contribution deadlines

- Misunderstanding salary components

Solutions:

- Automate via payroll software

- Use reminders

- Outsource to compliance experts like MUSTRE

Solidify Your HR Compliance With EPF Mastery

Getting your Malaysia EPF contribution process right is more than avoiding penalties—it’s about creating a culture of transparency and compliance in your company.

By mastering these 10 rules, you protect your business and earn your employees’ trust.

Related article

FAQ

1. What is malaysia epf contribution?

The malaysia epf contribution is the mandatory payment system where both employer and employee contribute to the employees provident fund. Employers must calculate, deduct, and remit the epf malaysia contribution accurately to comply with Malaysian law.

2. What are the EPF contribution rates in Malaysia?

The epf contribution malaysia rates are: employers pay 13% for employees earning RM5,000 or less, 12% for employees earning above RM5,000, and employees contribute 11% of their wages. The employer’s share is called the epf company contribution.

3. Which salary components are included in EPF contributions?

Included in the employees provident fund contributions are basic salary, allowances, overtime, bonuses, and commissions. Reimbursements, travel claims, and retirement gratuities are excluded.

4. When and how should employers remit contributions?

Employers must remit both the epf company contribution and employee contributions by the 15th of every month using KWSP i-Akaun, FPX online banking, or payroll software to ensure the epf malaysia contribution is correctly processed.

5. What are the consequences of non-compliance?

Failing to remit the malaysia epf contribution or manage the epf company contribution correctly can result in fines up to RM10,000, audits, dividend charges, and legal action. Accurate management protects your business and employees’ rights under the employees provident fund.

Need Help with EPF or Payroll?

MUSTRE offers expert HR outsourcing tailored for Malaysian SMEs and startups.

We help you handle payroll, EPF, SOCSO, EIS, and compliance—all under one roof.

👉 Contact us now for a free consultation and streamline your HR processes without the stress.